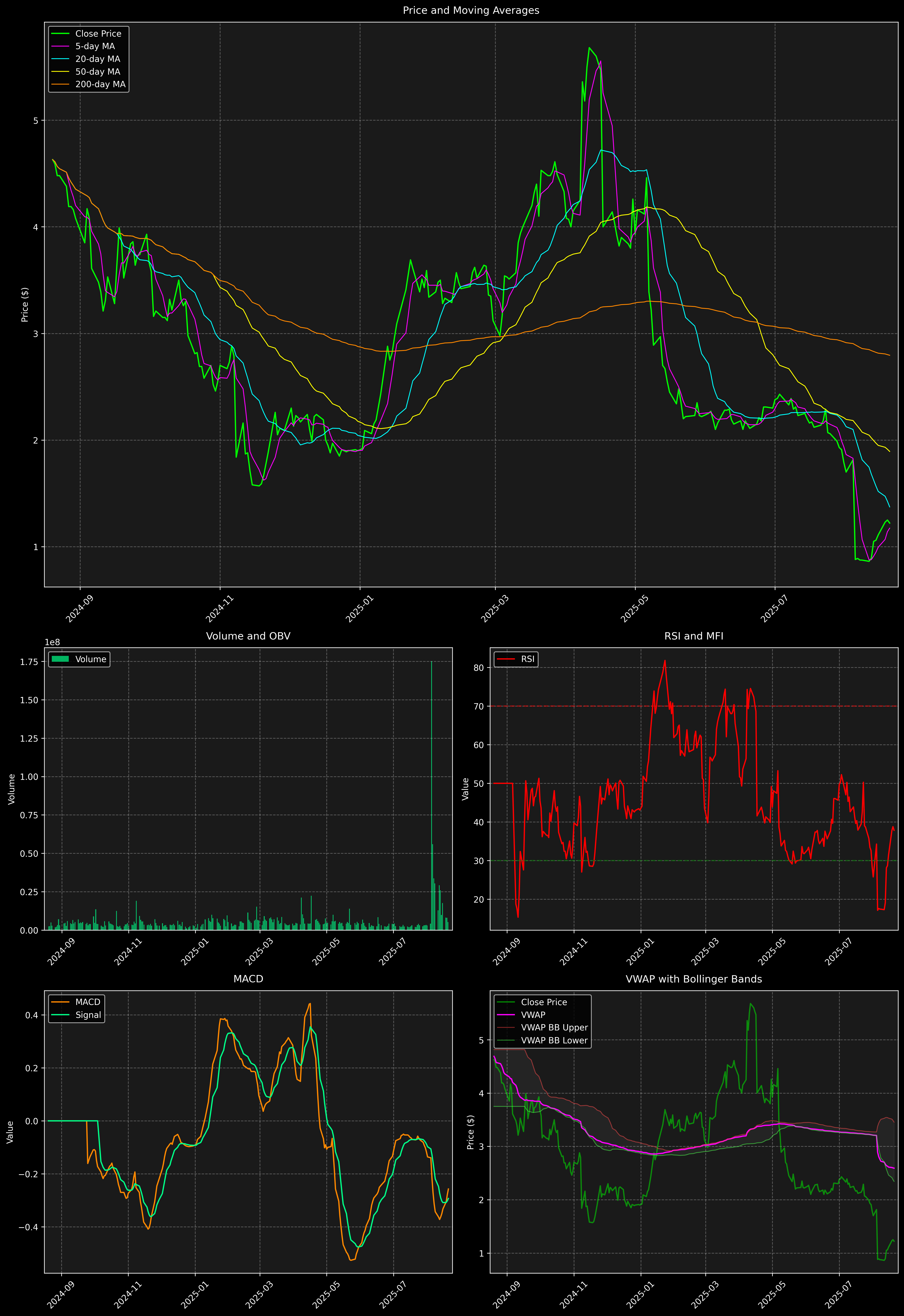

StockStory - 2025-08-20 16:45

Shares of healthcare services company Agilon Health (NYSE:AGL) fell 4.4% in the afternoon session after the company was downgraded by analysts at Bernstein from “Outperform” to “Market Perform”. The firm also slashed its price target on the stock by 65% to $1.40 from $4.00. Analyst Lance Wilkes cited “worse-than-expected margin pressures” following a disappointing quarter where the company's medical margin was a negative $53 million. This was primarily driven by lower-than-expected risk adjustme